Cyber Insurance Market Overview:

The cyber insurance market is poised for substantial growth as businesses and individuals worldwide prioritize protecting themselves against escalating cyber threats. Estimated at USD 12.38 billion in 2023, the market is projected to increase from USD 13.85 billion in 2024 to USD 34.0 billion by 2032, with a compound annual growth rate (CAGR) of 11.88% over the forecast period (2024 - 2032). This growth reflects the critical role cyber insurance plays in safeguarding assets and data in today’s digital-first world, where threats such as ransomware, data breaches, and other cyberattacks continue to proliferate.

Request a Free Sample - https://www.wiseguyreports.com/sample-request?id=571502

Key Drivers of the Cyber Insurance Market

Rising Cyber Threats and Data Breaches With the frequency and sophistication of cyberattacks escalating, organizations across industries are prioritizing cyber insurance. Ransomware attacks, data breaches, and other types of malicious activity have led to significant financial losses, and cyber insurance helps mitigate these risks by covering associated costs and liabilities.

Increased Data Privacy Regulations Governments worldwide are implementing stringent data privacy regulations, such as the GDPR in Europe and the CCPA in California. Compliance with these regulations is critical, and cyber insurance can assist businesses in managing legal expenses, regulatory fines, and penalties if a data breach occurs.

Digital Transformation and IoT Expansion As companies adopt digital technologies and integrate Internet of Things (IoT) devices into their operations, their exposure to cyber risks increases. Cyber insurance is essential for mitigating the risks associated with expanded digital footprints, which include connected devices, cloud services, and remote working environments.

Rising Awareness Among Small and Medium Enterprises (SMEs) Historically, large corporations were the primary buyers of cyber insurance, but this is changing. SMEs are increasingly recognizing the need for cyber insurance as they become more digitally connected and face similar risks. Insurers are offering tailored products for smaller organizations to make cyber insurance more accessible to this segment.

Increased Demand for Remote Work Security Solutions The shift to remote work has expanded the potential attack surface for many businesses, making them more susceptible to cyber threats. With more devices and home networks connected to corporate systems, cyber insurance has become essential for protecting against data breaches and other incidents resulting from remote work vulnerabilities.

Market Segmentation

The cyber insurance market can be segmented by coverage type, organization size, end-user industry, and region.

By Coverage Type:

First-Party Coverage: Covers direct losses incurred by the policyholder, such as data loss, system damage, and business interruption.

Third-Party Coverage: Protects against claims filed by external entities affected by the policyholder’s data breach or cyber incident, including legal fees and liability costs.

By Organization Size:

Large Enterprises: Large companies are typically early adopters of comprehensive cyber insurance policies, as they have complex infrastructures and handle significant volumes of sensitive data.

Small and Medium Enterprises (SMEs): SMEs are increasingly purchasing cyber insurance due to their growing awareness of cyber risks and rising vulnerabilities in digital operations.

By End-User Industry:

Healthcare: The healthcare sector is a major driver of the cyber insurance market due to the sensitive nature of patient data and the high risk of cyberattacks.

Financial Services: Financial institutions are prime targets for cybercriminals, and this sector accounts for a significant share of cyber insurance demand.

Retail and E-Commerce: With large customer databases and extensive online operations, retail companies face high exposure to cyber risks, making them key consumers of cyber insurance.

IT and Telecommunications: This sector is highly interconnected and reliant on digital networks, making it particularly susceptible to cyber threats.

Others: Other industries, such as manufacturing, energy, and government, are also increasingly adopting cyber insurance to protect against cyber risks.

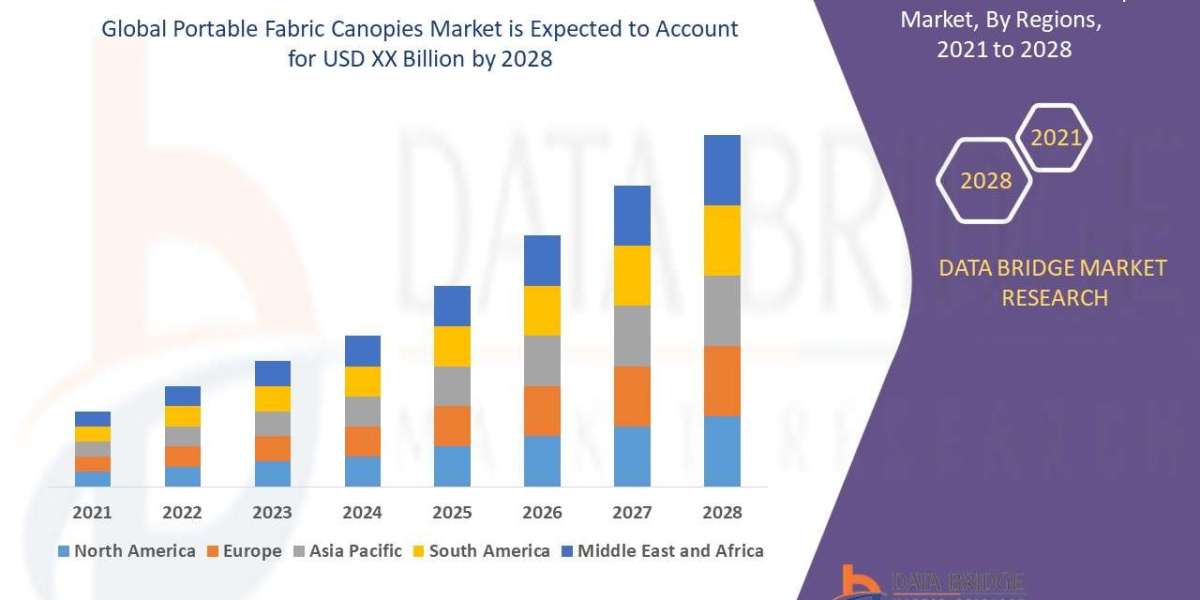

By Region:

North America: Leading the cyber insurance market, North America’s growth is driven by advanced digital infrastructure and high awareness of cyber threats.

Europe: Europe has a well-established cyber insurance market, with stringent data privacy regulations (e.g., GDPR) encouraging organizations to adopt cyber insurance.

Asia-Pacific: Growing digitalization, increased cybersecurity threats, and awareness among organizations contribute to the rapid growth of the cyber insurance market in Asia-Pacific.

Latin America, Middle East, and Africa: Cyber insurance adoption is gradually increasing in these regions as digital transformation accelerates, though adoption remains lower compared to more developed regions.

Key Trends Shaping the Market

Increased Coverage Customization Insurers are increasingly offering customized cyber insurance policies to cater to the specific needs of different industries and organizational sizes. Customization allows companies to focus on coverage for particular risks, such as data breach response, ransomware attacks, and social engineering fraud.

Integration of Cyber Risk Assessment Tools Insurers are utilizing advanced risk assessment tools to better evaluate a company's cyber risk profile, allowing for more accurate premium pricing and tailored coverage. This trend helps businesses understand their vulnerabilities and incentivizes proactive cybersecurity measures.

Inclusion of Ransomware Coverage With ransomware incidents on the rise, insurers are adding specialized ransomware coverage to cyber insurance policies. These policies cover ransom payments, as well as the costs associated with data recovery, legal expenses, and potential regulatory penalties.

Increased Focus on Cybersecurity Partnerships Many insurers are forming partnerships with cybersecurity companies to offer clients bundled services that combine cyber insurance coverage with proactive cybersecurity solutions. This trend helps businesses improve their defenses and reduce the likelihood of incidents.

Premium Adjustments and Policy Exclusions As cyber threats evolve, insurers are adjusting premiums to reflect the increased risk. Some insurers are also setting limits on coverage for certain types of incidents, such as state-sponsored attacks, prompting businesses to invest in additional cybersecurity measures.

Challenges in the Cyber Insurance Market

Difficulty in Pricing and Underwriting Cyber risks are challenging to quantify, and the lack of historical data on cyber incidents makes pricing and underwriting cyber insurance complex. Insurers are investing in predictive analytics and AI tools to improve their ability to assess cyber risk, but challenges remain in accurately pricing policies.

Lack of Standardization Cyber insurance policies vary widely across providers, leading to a lack of standardization in coverage. Businesses may find it challenging to compare policies, and this inconsistency complicates the claims process.

Uncertain Regulatory Environment The regulatory landscape for cybersecurity and data privacy is continuously evolving, impacting the scope of cyber insurance coverage. Companies and insurers must stay informed about changing regulations to ensure compliance and maintain adequate protection.

Coverage Limitations Some policies may exclude coverage for specific types of cyberattacks, such as those associated with state-sponsored cyber warfare. Companies must be aware of these limitations to understand the extent of their protection and consider additional cybersecurity measures if needed.

Regional Insights

North America: North America is the leading region in the cyber insurance market, driven by high levels of digitalization, a proactive approach to cybersecurity, and widespread awareness of cyber threats. The U.S. is a major market, with companies across sectors prioritizing cyber insurance.

Europe: Europe’s cyber insurance market is growing due to the enforcement of the GDPR, which has increased awareness about data privacy and the need for insurance coverage. The financial services and healthcare sectors are among the largest consumers of cyber insurance in the region.

Asia-Pacific: This region is seeing a rapid increase in cyber insurance adoption, with growing digital economies and rising awareness of cyber risks. Countries like China, Japan, and India are expected to drive growth in the Asia-Pacific market as they implement cybersecurity regulations and encourage insurance adoption.

Latin America, Middle East, and Africa: Cyber insurance is gradually gaining traction in these regions, though growth is slower compared to North America and Europe. As digital transformation continues, more organizations in these regions are expected to invest in cyber insurance.

Future Outlook

The cyber insurance market is set to expand significantly, reaching an estimated USD 34.0 billion by 2032. As cyber threats evolve, businesses will increasingly view cyber insurance as an essential component of their risk management strategies. The market will continue to adapt to emerging technologies, regulatory changes, and evolving threats, offering businesses and individuals protection against the financial impacts of cyber incidents.

As organizations across industries continue their digital transformation journeys, cyber insurance will play a pivotal role in safeguarding financial assets and reputations. Businesses that adopt comprehensive cybersecurity strategies, including cyber insurance, will be better positioned to manage risks in an ever-evolving digital landscape.