Executive Summary Trade Surveillance Market :

CAGR Value

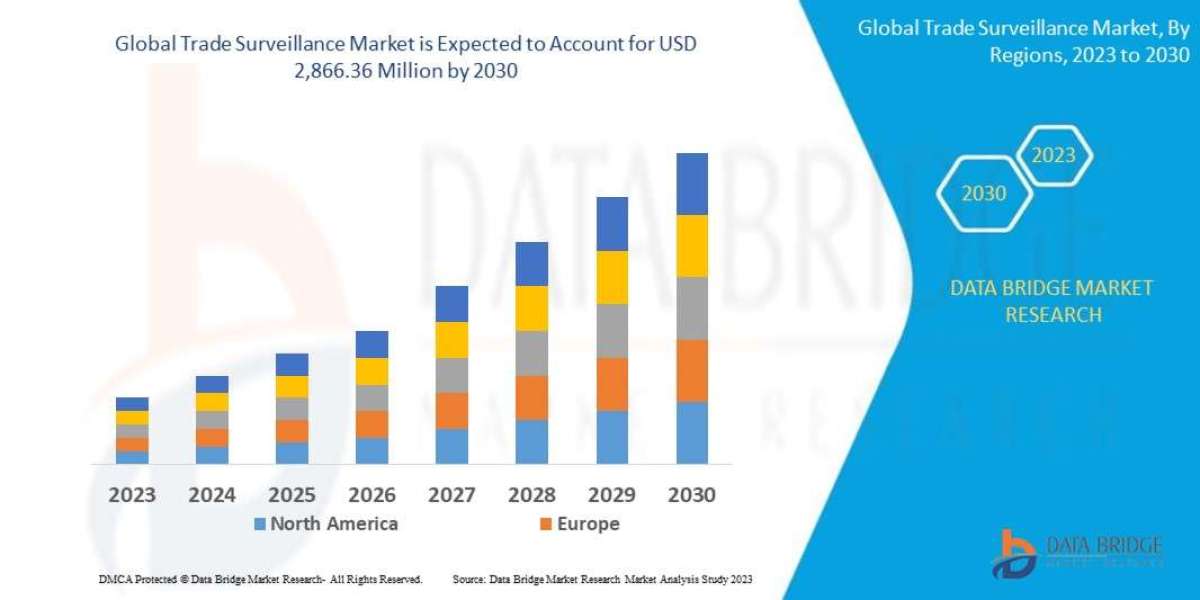

Data Bridge Market Research analyses that the global trade surveillance market which was USD 902.21 million in 2022, is expected to reach USD 2,866.36 million by 2030, and is expected to undergo a CAGR of 13.9% during the forecast period 2023-2030.

The transparent, trustworthy and extensive market information and data included in this Trade Surveillance Market business report will definitely help develop business and improve return on investment (ROI). The market report estimates the region that is foretold to create the most number of opportunities in the global Trade Surveillance Market. It figures out whether there will be any changes in market competition during the forecast period. These insights are often critical to key business processes such as product planning, new product development, distribution route planning and sales force development. The report really serves to be a proven solution for businesses to gain a competitive advantage.

With this Trade Surveillance Market report you can focus on the data and realities of the industry which keeps your business on the right path. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the market has also been included. The data and information collected to generate this top-quality market report has been derived from the trusted sources such as company websites, white papers, journals, and mergers etc. The Trade Surveillance Market research report acts as a strong backbone for industry with which it can outdo the competition.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Trade Surveillance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-trade-surveillance-market

Trade Surveillance Market Overview

**Segments**

- Based on component, the trade surveillance market can be segmented into solution and services. The solution segment can further be categorized into risk & compliance, surveillance & monitoring, reporting & analytics, case management, and others. The services segment can include professional services and managed services.

- By deployment type, the market can be divided into cloud and on-premises. The cloud deployment is expected to witness significant growth due to its cost-effectiveness, scalability, and flexibility.

- In terms of organization size, the market can be classified into small & medium enterprises (SMEs) and large enterprises. With the increasing adoption of advanced trade surveillance solutions, large enterprises are likely to dominate the market share.

- Considering the end-user industry, the market can be segmented into banking, financial services & insurance (BFSI), healthcare, retail & e-commerce, manufacturing, and others. The BFSI sector is anticipated to hold a substantial market share owing to the stringent regulations and increasing focus on risk management.

**Market Players**

- Nasdaq, Inc.

- FIS

- Cisco

- Nice Systems Ltd.

- Fidelity National Information Services, Inc.

- Software AG

- OneMarketData, LLC

- IPC Systems, Inc.

- B-Next

- Aquis Technologies

The global trade surveillance market is witnessing significant growth due to the rising demand for monitoring and analyzing trade activities to prevent fraud, market abuse, and insider trading. With the increasing complexities in financial transactions and stringent regulations imposed by regulatory authorities, the adoption of trade surveillance solutions is expected to surge. Key market players are focusing on advanced technologies such as artificial intelligence (AI) and machine learning to enhance the surveillance capabilities and provide real-time insights to financial institutions. The market is highly competitive, with companies investing in research and development activities to introduce innovative solutions and gain a competitive edge. North America is anticipated to dominate the market share, followed by Europe and Asia-Pacific regions. The Asia-Pacific market is projected to witness significant growth due to the rapid digital transformation in emerging economies like China and India.

The global trade surveillance market is experiencing a paradigm shift driven by technological advancements and evolving regulatory landscapes. One of the key trends shaping the market is the increasing integration of artificial intelligence (AI) and machine learning algorithms in surveillance solutions. These technologies enable financial institutions to analyze vast amounts of data in real-time, detect anomalies, and identify suspicious trading patterns more effectively. By leveraging AI-driven tools, market players can enhance their surveillance capabilities, automate compliance processes, and adapt to the growing complexity of financial markets.

Moreover, there is a growing emphasis on holistic surveillance approaches that encompass not only traditional market monitoring but also social media monitoring, voice and email communication analysis, and trade reconstruction. This multi-dimensional surveillance strategy enables firms to gain a comprehensive view of potential risks and compliance breaches across various communication channels and trading activities. As regulatory scrutiny intensifies and the scope of surveillance expands, market players are increasingly investing in comprehensive solutions that offer a 360-degree view of their trading operations.

Another significant development in the trade surveillance market is the rising demand for cloud-based deployments. Cloud technology offers scalability, flexibility, and cost-efficiency, making it an attractive option for financial institutions looking to modernize their surveillance infrastructure. As cloud security measures continue to advance and address industry-specific requirements, more organizations are expected to transition from on-premises solutions to cloud-based platforms in the coming years.

Furthermore, the convergence of trade surveillance with other compliance functions, such as anti-money laundering (AML) and fraud detection, is gaining traction in the market. Integrated compliance solutions allow firms to streamline their risk management processes, reduce operational silos, and improve overall regulatory compliance. By consolidating different compliance functions into a unified platform, companies can enhance their operational efficiency, mitigate compliance risks, and ensure a more cohesive approach to regulatory requirements.

In conclusion, the global trade surveillance market is undergoing a transformation driven by technological innovation, regulatory dynamics, and evolving market trends. Market players are adapting to these changes by investing in advanced surveillance solutions, harnessing the power of AI and machine learning, embracing cloud technology, and integrating surveillance with other compliance functions. As the market continues to evolve, organizations that prioritize innovation, agility, and regulatory adherence will be better positioned to navigate the complexities of modern trade surveillance and drive sustainable growth in the competitive landscape.The global trade surveillance market is currently undergoing a significant transformation driven by various factors such as technological advancements, regulatory landscapes, and evolving market trends. One of the key trends shaping the market is the increasing integration of artificial intelligence (AI) and machine learning algorithms in surveillance solutions. This integration allows financial institutions to analyze vast amounts of data in real-time, enabling them to detect anomalies and identify suspicious trading patterns more effectively. By leveraging AI-driven tools, market players can enhance their surveillance capabilities, automate compliance processes, and adapt to the growing complexity of financial markets.

Another important trend in the trade surveillance market is the shift towards holistic surveillance approaches that go beyond traditional market monitoring. Firms are now incorporating social media monitoring, voice and email communication analysis, and trade reconstruction into their surveillance strategies. This multi-dimensional approach provides a comprehensive view of potential risks and compliance breaches across various communication channels and trading activities. As regulatory scrutiny intensifies, companies are increasingly investing in comprehensive solutions that offer a 360-degree view of their trading operations.

Cloud-based deployments are also gaining traction in the trade surveillance market due to their scalability, flexibility, and cost-efficiency. Cloud technology offers financial institutions the opportunity to modernize their surveillance infrastructure and adapt to changing market dynamics. As cloud security measures continue to advance, more organizations are expected to transition from on-premises solutions to cloud-based platforms.

Furthermore, the convergence of trade surveillance with other compliance functions like anti-money laundering (AML) and fraud detection is becoming more prevalent. Integrated compliance solutions enable firms to streamline their risk management processes, reduce operational silos, and enhance overall regulatory compliance. By consolidating different compliance functions into a unified platform, companies can improve operational efficiency, mitigate compliance risks, and ensure a more cohesive approach to regulatory requirements.

Overall, the global trade surveillance market is evolving rapidly, with market players embracing advanced technologies, cloud deployment models, and integrated compliance solutions to meet the growing demands of regulatory authorities and combat financial crimes effectively. The market landscape is expected to continue evolving as organizations prioritize innovation, agility, and regulatory adherence to drive sustainable growth and competitive advantage.

The Trade Surveillance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-trade-surveillance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Coverage in the Trade Surveillance Market Report:

- Detailed analysis of Global Trade Surveillance Marketby a thorough assessment of the technology, product type, application, and other key segments of the report

- Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

- Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

- Comprehensive analysis of the regions of the Trade Surveillance Marketand their futuristic growth outlook

- Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

Browse More Reports:

Asia-Pacific Aroma Chemicals Market

North America Automotive Magnet Wire Market

Global Infectious Mononucleosis Market

Global Trade Surveillance Market

Global Concentrated Photovoltaic (PV) (Concentrated Photovoltaic (Cvp) and High Concentrated Photovoltaic (Hcvp)) Market

Global Irradiation Apparatus Market

Global Hematology (CBC) Analysers Market

Global Automotive Door Guards Market

Asia-Pacific Bullet Proof Glass Market

Europe Torque Limiter Market

Global Cybersecurity Market

Global Scleritis Market

Global Converged Cable Access Platform (CCAP) Market

Global Mobile Customer Relationship Management Market

Global Oculoplastic Surgery Market

Europe Disposable Medical Devices Sensors Market

Global Azacitidine Market

Global Caps and Closures Market

Global Tablets Market

Global Silk Market

Global Automotive Magnet Wire Market

North America Liquid Filtration Market

Global Air Fryer Market

Global Bickers Adams Edwards Syndrome Market

Global Steroid Injections Market

Global Medical Waste Management Market

Global Prostate Cancer Diagnostics Market

Global Field Programmable Gate Array (FPGA) Security Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com