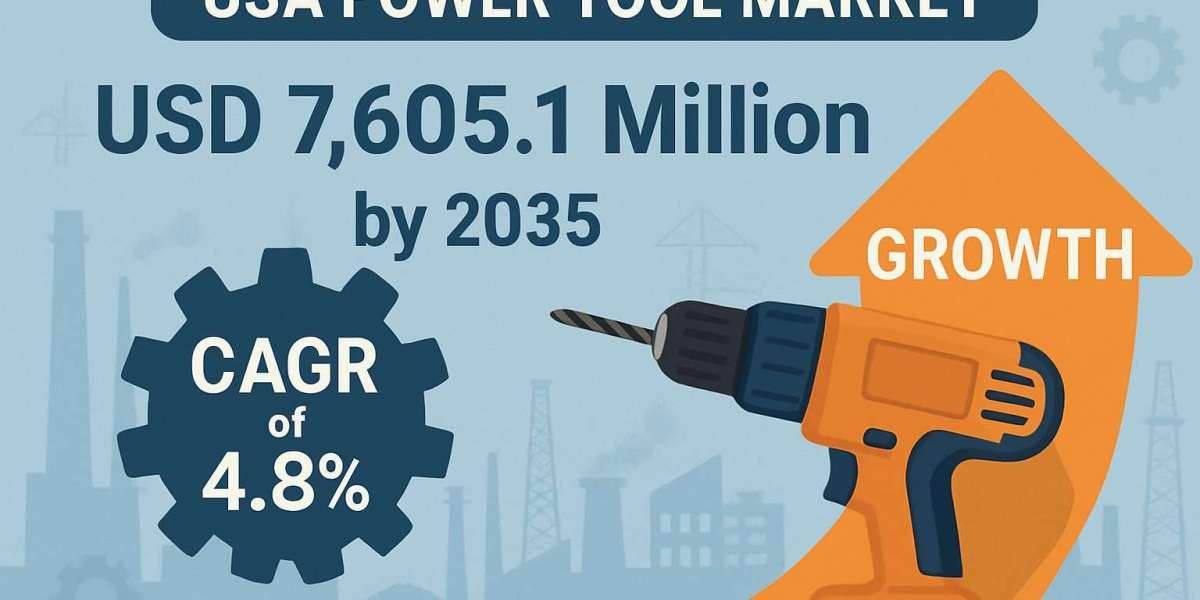

The USA power tool market is poised for consistent growth over the coming decade, fueled by rising demand across key industries such as construction, automotive, and manufacturing. Valued at USD 4,867.3 million in 2025, the market is expected to expand to USD 7,605.1 million by 2035, reflecting a robust CAGR of 4.8%. This upward trajectory is driven by increased infrastructure development, rapid advancements in cordless tool technology, and the growing adoption of automation across industrial operations.

Recent market projections indicate that the USA power tool market will experience strong growth in the coming decade. With technological innovation at its core, the market is expected to expand steadily from USD 11.2 billion in 2025 to approximately USD 16.8 billion by 2035, registering a healthy CAGR of 4.2%. This surge is supported by rising consumer spending, increased infrastructure investments, and a shift toward cordless, battery-operated, and smart tool offerings that provide better mobility, safety, and operational efficiency.

Stay Informed on Key Market Changes: Get a Sample Report!

Key Industry Highlights

- Smart and Connected Power Tool Solutions: The market is witnessing a surge in demand for smart power tool systems that integrate with IoT platforms and mobile applications. Features such as real-time usage tracking, predictive maintenance alerts, and remote access are becoming key differentiators in residential and commercial settings.

- Cordless Power Tool Adoption Accelerates: The rapid advancement of lithium-ion battery technology has led to widespread popularity of cordless power tool variants. These are now preferred in numerous applications due to improved portability, energy efficiency, and operational safety.

- DIY Segment Fuels Market Demand: As more consumers engage in home renovation and improvement projects, especially post-pandemic, the demand for lightweight and compact power tool products has surged. From woodworking to garden maintenance, the DIY boom continues to shape purchasing patterns.

- Digital Sales Channels Boost Market Reach: The expansion of e-commerce platforms such as Amazon, Home Depot, and Lowe’s has revolutionized power tool distribution. Competitive pricing, product comparisons, user reviews, and fast delivery are encouraging both consumers and professionals to shop online

Collaboration between Small Market Players to Strengthen Product Portfolio

Despite the presence of global market leaders, collaboration among small and mid-sized manufacturers is becoming increasingly common as a strategy to diversify and strengthen their power tool portfolios. Strategic alliances with battery developers, design firms, and digital solution providers are enabling smaller players to compete in niche markets.

Partnerships are helping regional firms co-develop cordless or smart power tool innovations tailored for specific use-cases—such as ergonomic designs for elderly users, low-noise systems for residential areas, or eco-friendly tool configurations for green construction practices. These collaborations also provide access to new distribution channels, specialized manufacturing processes, and faster go-to-market timelines.

By pooling technical expertise and capital resources, small manufacturers are not only enhancing product performance but also reducing time-to-market—key in responding to fast-evolving customer expectations.

Market Concentration

The USA power tool market is moderately consolidated, with several dominant players controlling a significant portion of overall revenues. Leading companies such as Stanley Black & Decker, Bosch, Makita, Hilti, and Techtronic Industries (Milwaukee) maintain strong footholds due to their broad product range, brand equity, and consistent investment in innovation.

However, market concentration has not deterred the emergence of new players. Many local and regional firms are carving out space by focusing on underserved categories, including lightweight DIY equipment, renewable-energy-powered tool products, and affordable multi-functional kits. The growing appetite for niche tool types has also allowed newcomers to target specialized verticals such as aerospace maintenance, renewable infrastructure, and compact living solutions.

Large players continue to consolidate their market share by acquiring emerging startups, launching customer-centric platforms, and offering personalized service packages that create long-term value for both individual and enterprise clients.

Country-wise Insights Across the USA

- California: A hub for real estate development and smart home projects, California is driving demand for high-tech power tool solutions. Integration with smart devices and eco-compliant designs are top trends in this region.

- Texas: As a center for oil, energy, and large-scale infrastructure projects, Texas exhibits strong demand for heavy-duty industrial power tool equipment, especially in construction and fabrication.

- Florida: High homeowner density and frequent remodeling activity in Florida support strong sales of compact and user-friendly power tool options suited for outdoor maintenance and residential upgrades.

- Midwest (e.g., Michigan, Illinois, Ohio): The Midwest, known for its strong automotive and manufacturing base, demonstrates consistent demand for precision power tool products for metalworking and assembly-line operations.

- Northeast (e.g., New York, Pennsylvania, Massachusetts): This region emphasizes sustainability and high-rise construction, leading to greater adoption of energy-efficient, low-noise power tool equipment.

Competition Outlook

In addition to these established companies, brands like Ryobi, Skil, Ridgid, and Kobalt are strengthening their position in the entry-level and prosumer markets by offering accessible pricing, DIY-centric toolkits, and broad availability through big-box retailers.

Key Players

- Stanley Black & Decker

- Bosch

- Makita

- Milwaukee Tool (Techtronic Industries - TTI)

- Hilti

- RIDGID

- Ryobi (TTI)

- Festool

- Metabo

- Kobalt (Lowe’s Brand) & Hercules (Harbor Freight)

Key Segmentation

By Product Type:

In terms of Products, the industry is divided into Drilling Tool, Fastening Tool, Heat Gun, Angle Grinder, Chain Saw, Orbital Sander, Jigsaw, Impact Wrench, and Circular Saw.

By Application:

In terms of Application, the industry is segregated into Manufacturing, MRO Services, DIY, and Construction.

By Region:

The report covers key regions, including Northeast USA, Southeast USA, Midwest USA, Southwest USA, West USA